Here are a few tips on how to plan for your future home NOW. This is all from my experience saving and purchasing my own home.

Skip the Big Wedding

If you want to save big money to help you plan for your future home, you should skip the big wedding. Weddings cost a fortune ($40k+) whether you save for them or pay for them afterward. You will be better served by saving your money for a house. Think about what you would have spent and put that away towards your home purchase.

Eat at Home

Eating out is extremely expensive. The second best way to save money is to eat at home. You can use this one in coordination with clipping coupons and save tons of money each week. Put the excess money you save into savings.

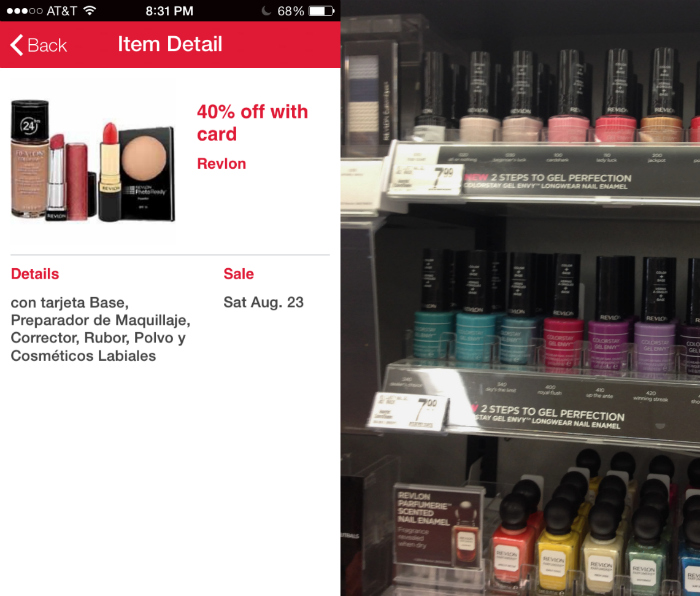

Clip Coupons

Clip coupons online and on your phone by downloading apps for the stores that you frequent. I always have my phone fully charged when I shop so that I can scan the items as I shop. This way I never miss out on a deal.

Make Coffee at Home

You can save a ton of money by skipping the trip to the coffee shop. Make your coffee at home and the office. If someone offers you a free cup throughout the day, always take it.

Don’t Quit your Day Job

Not quitting your day job may sound obvious, but it was not obvious to me when I was buying my house. I left my day job with a steady income right before we bought our house to pursue blogging full time. I am all for entrepreneurial endeavors, but I would wait to take the leap until after you buy big ticket items like cars and homes.

Write Down a Plan

Start with how much money you will need to save. One of the first steps is figuring out how much home you can afford. Start by sticking to the right price range. A rule of thumb is to look at houses that are 2.5 times your annual salary. The traditional estimate for a down payment is 20 percent of the purchase price of the house, which can lower your monthly payments and avoid mortgage insurance better than a lower down payment.

Find the Right Bank

Capital One’s goal is to help first-time homebuyers understand how the home loan process works. They recently launched a new online learning center that features the know-how they’ll need to become the savviest homeowners on the block.They’ve gathered easy-to-understand articles and helpful videos, as well as information about Capital One’s Home Loans offerings. They show you the groundwork with a glossary of terms FHB (First Time Home Buyers) should know. If you’re interested in learning more about Capital One Home Loans and how we can help you get home, visit https://www.capitalone.com/home-loans/direct/learning-center or call us at 855-900-8886.

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.